WASHINGTON/PARIS - A transformative shift is underway in the global food manufacturing sector as new technologies and aggressive government policies converge to tackle the industry's massive environmental footprint. In a move that signals a decisive pivot for the sector, the Biden-Harris Administration announced a National Strategy for Reducing Food Loss and Waste and Recycling Organics on June 12, 2024. This federal mandate is now acting as a catalyst, accelerating the adoption of decentralized production models and advanced energy systems designed to sever the link between food security and carbon emissions.

The urgency of this transition is underscored by recent data indicating that food systems are a primary driver of global greenhouse gas (GHG) emissions. With the integration of autonomous micro-factories and biotechnology-driven feed production, the industry is moving beyond voluntary pledges to structural re-engineering. Experts suggest that these developments are not merely environmental adjustments but essential survival strategies for businesses facing volatile energy markets and increasingly conscientious consumers.

Timeline of Transformation

The trajectory of the last 18 months highlights a rapid escalation in both technological deployment and regulatory pressure. Key developments shaping the current landscape include:

- November 2023: Danone partners with the Global Methane Hub to fund research into reducing enteric emissions in dairy farming, marking a major corporate investment in upstream emission control.

- March 2024: Industry reports highlight the efficacy of adopting energy-efficient technologies and investing in renewable sources to mitigate GHG impacts in manufacturing.

- June 2024: The USDA, EPA, and FDA jointly launch the National Strategy for Reducing Food Loss and Waste, formalizing federal commitment to circular economy principles.

- September 2024: A collaboration between Danone and Ajinomoto Group is announced to cut emissions specifically within milk collection networks, targeting the logistics aspect of the supply chain.

Technological Innovation and Decentralization

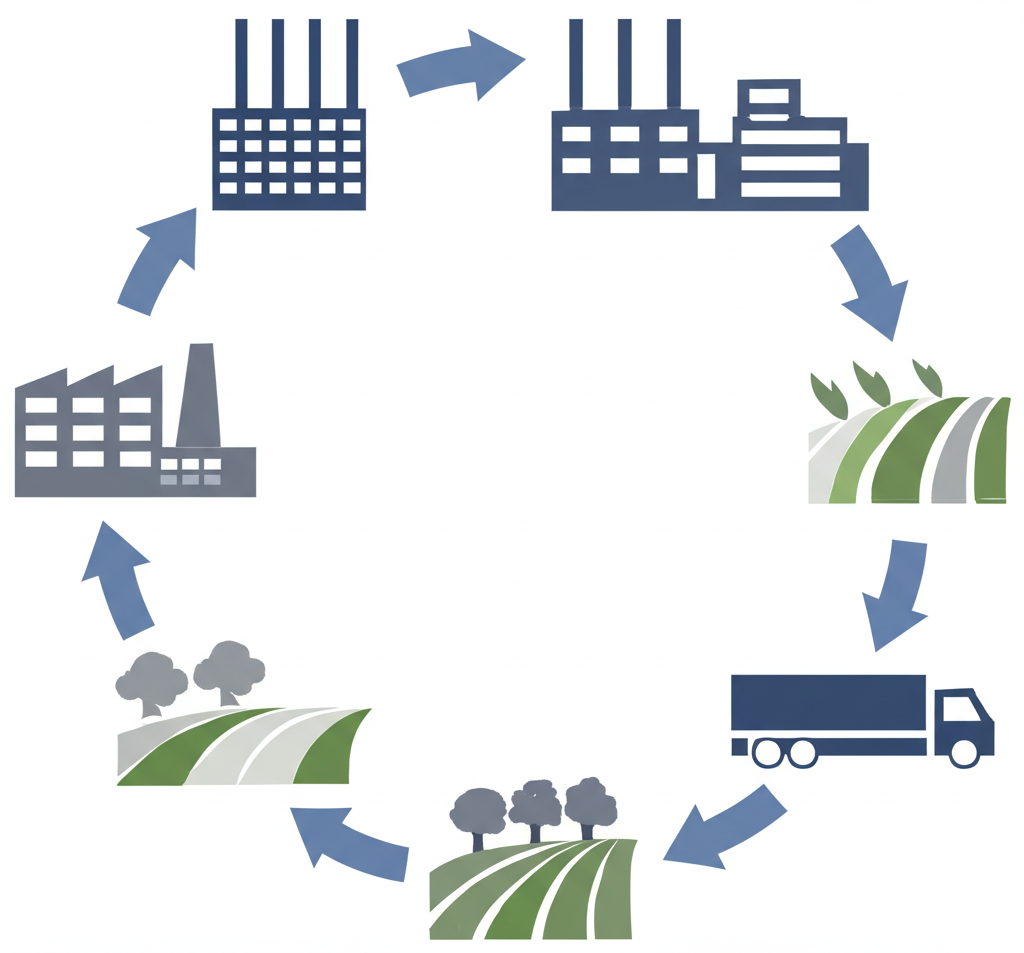

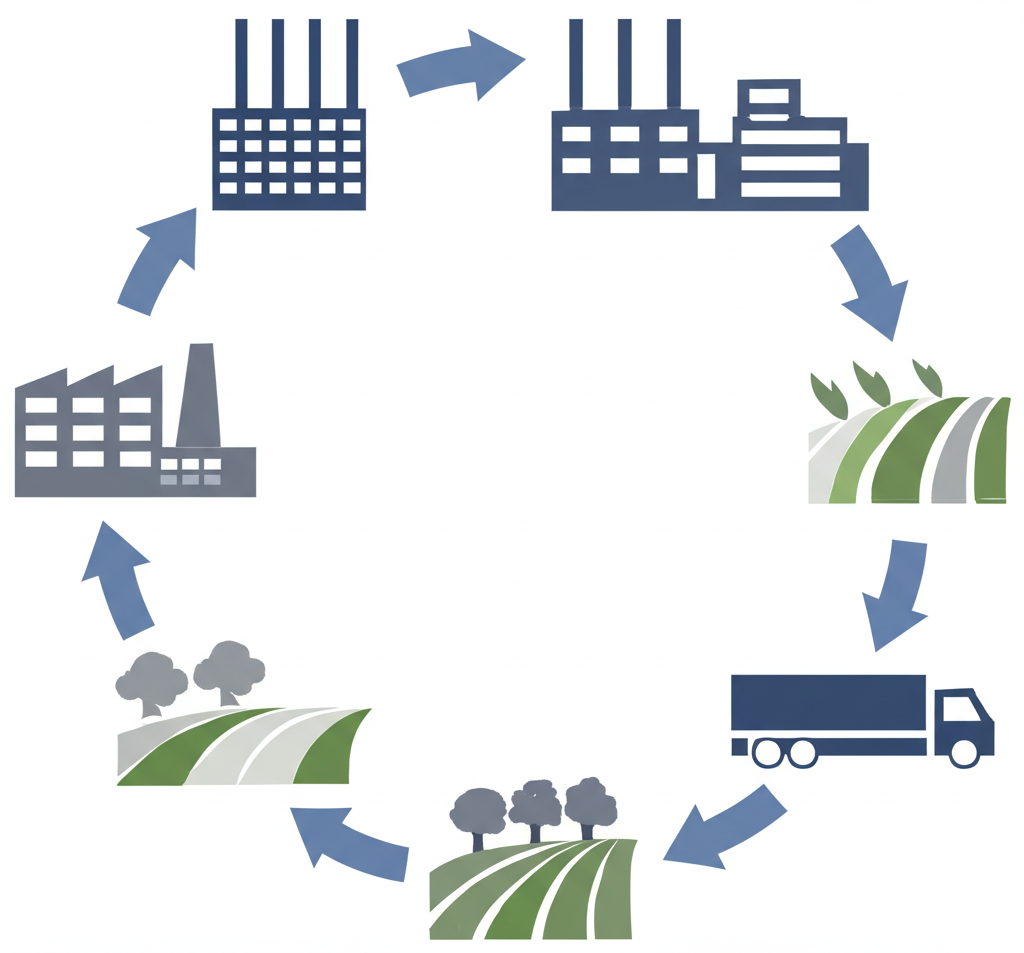

One of the most radical shifts in the sector is the move toward decentralization. Traditional food manufacturing has relied on massive, centralized plants that require extensive cold chains to distribute products. However, startups like Relocalize are challenging this paradigm in 2024 by deploying autonomous micro-factories. By decentralizing production and packaging, these units reduce the transportation miles required-a critical component of Scope 3 emissions-and make local food systems more scalable and affordable.

Furthermore, efficiency within existing facilities is being revolutionized through trigeneration systems. According to the "Food Forward NDCs" initiative, investing in these systems-which simultaneously generate electricity, heating, and cooling from a single fuel source-is a key measure for reducing emissions in food storage and processing. This aligns with broader industry trends where companies are leveraging real-time data and waste tracking systems to optimize production processes.

"Food manufacturers can mitigate the impact of greenhouse gas emissions by adopting energy-efficient technologies, investing in renewable energy sources, and implementing carbon reduction strategies." - Emissis Report, March 2024

Corporate Action and Energy Transition

Renewable Energy Adoption

Major players are aggressively altering their energy profiles. Reports from MDPI indicate that Kellogg Company has significantly decreased its dependence on fossil energy, with over 40% of electricity in its manufacturing facilities generated from renewable sources like wind and solar by 2022. Similarly, PepsiCo achieved a 25% reduction in Scope 1 and 2 emissions by procuring renewable electricity. Innovative fuel sources are also emerging; the use of husk-coal blends has been shown to dramatically decrease coal consumption, cutting nearly 17,600 metric tons of GHG emissions in pilot applications.

Tackling Scope 3 Emissions

Scope 3 emissions-those occurring indirectly in the value chain-remain the most challenging hurdle. For food manufacturers, this often means addressing agriculture itself. Danone's partnership with the Global Methane Hub exemplifies the push to support regenerative agriculture. By developing solutions to limit enteric fermentation (methane release from livestock digestion), manufacturers are taking responsibility for the carbon footprint of their raw materials. This shift is supported by resources from organizations like AGRIVI, which guide farmers on carbon sequestration and efficient fertilizer use.

Implications for Policy and Society

The intersection of food policy and climate action is becoming increasingly formalized. New York City provides a localized example of this global trend. The city recently reported a 29% reduction in food procurement emissions from its 2019 baseline. Its strategy involves reducing reliance on ultra-processed foods and working directly with manufacturers to develop low-emission products, creating a model for how municipal demand can drive industrial change.

Economically, the case for sustainability is strengthening. Rabobank analysis suggests that energy-efficient solutions and renewable biogas utilization offer dual benefits: lowering carbon output and cutting operational costs. As TraceX Technologies notes, this aligns with a rise in "conscious consumerism," where transparency regarding ethical sourcing and carbon footprints is becoming a non-negotiable market demand.

Outlook: The Road to Net Zero

Looking ahead, the European Commission continues to prioritize biotechnology-driven low-emission systems for 2025 and beyond. Scientific roadmaps published in Nature suggest that achieving net-zero emissions by 2050 will require shifting production to the least emission-intensive systems and adopting new-horizon technologies capable of sequestering carbon at high rates.

The industry is entering a phase where waste reduction tools, such as active packaging and upcycling manufacturing byproducts, will become standard. With the carbon footprint of wasted food estimated at 3.3 tonnes of CO2 per tonne of product, the imperative to close the loop is clear. As governments tighten regulations and technology matures, the food manufacturing sector is poised to become a central pillar of the global green economy.