In a significant shift in United States technology policy, President Donald Trump has announced that Nvidia will be permitted to export its powerful H200 artificial intelligence chips to China. The decision, confirmed by administration officials in early December 2025, marks a departure from total export bans, opting instead for a regulated sales model that imposes a 25% surcharge on all transactions. The move appears designed to balance national security interests with the economic dominance of the American technology stack, even as federal prosecutors concurrently launch aggressive crackdowns on illicit chip smuggling networks.

According to reports from Reuters and Semafor, the administration has communicated this policy shift directly to Beijing. The authorization allows Nvidia to ship the H200-described as the company's "second-best" AI processor-only to "approved customers" within China. This pivot suggests a strategy of containment through dependency, allowing Chinese firms access to U.S. hardware under strict surveillance and taxation, rather than forcing them entirely toward domestic alternatives like Huawei.

The New Protocol: Tariffs and Approved Buyers

The core of the new policy is a conditional license framework. As reported by TechPowerUp, the Trump administration has approved a framework where 25% of the sales proceeds from these exports will be allocated to the U.S. government. This creates a unique revenue stream while theoretically keeping Chinese AI development tethered to U.S. supply chains.

CNN Business reports that President Trump informed Chinese President Xi Jinping that shipments would occur "under conditions that allow for continued strong National Security." This implies that the "approved customers" list will be vetted heavily by the Department of Commerce to ensure the chips are not diverted to military end-uses. The H200, which features 144 GB of HBM3 memory, remains a critical component for training large language models, making it a highly sought-after commodity in the global AI arms race.

The "Carrot and Stick": Crushing the Smuggling Rings

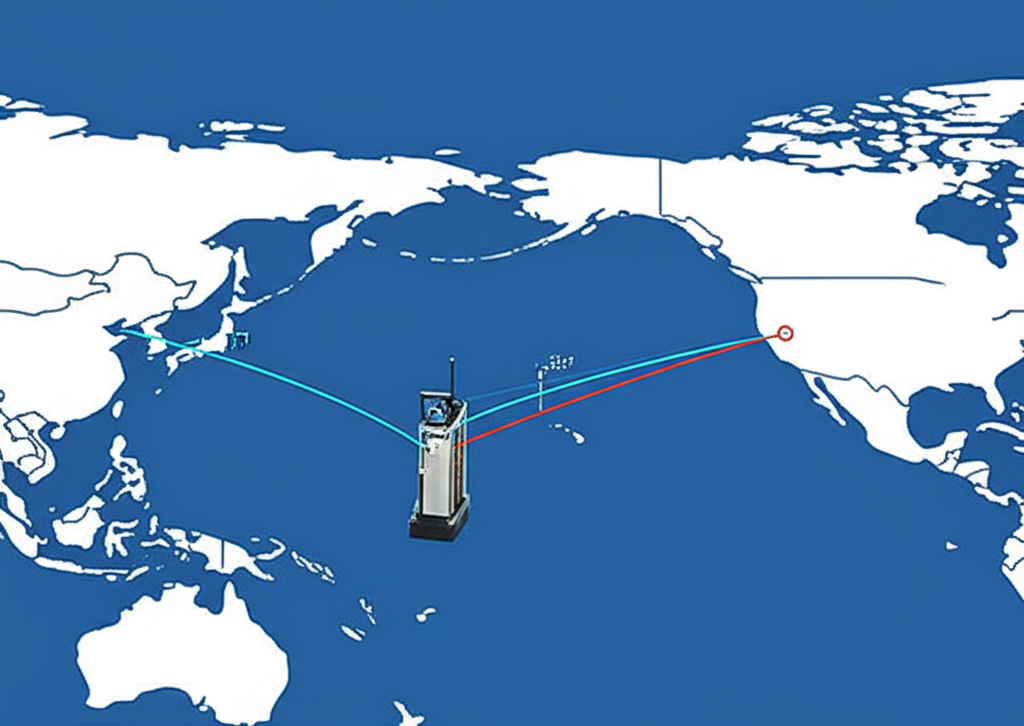

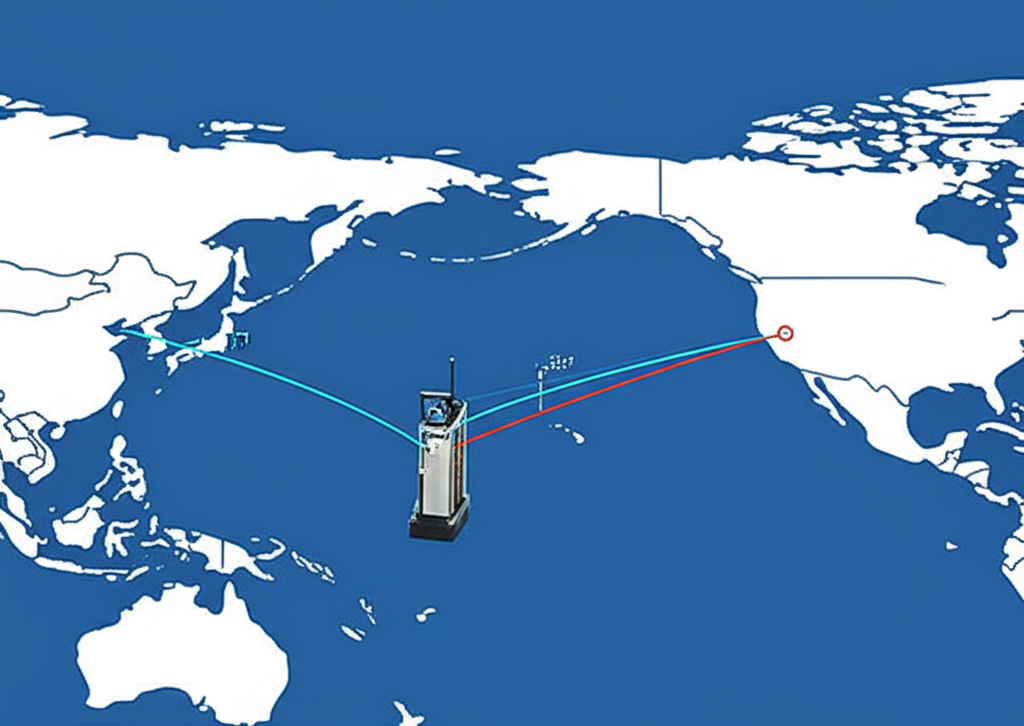

The legalization of H200 sales comes with a simultaneous crackdown on the black market. Just days after the policy announcement, the Department of Justice revealed significant prosecutions against chip smugglers. According to CyberScoop, federal prosecutors are pursuing cases against individuals involved with "Hao Global," an entity accused of exporting or attempting to export over 7,000 Nvidia H100 and H200 GPUs between 2024 and May 2025.

"Hsu and others used Hao Global to export, or attempt to export, more than 7,000 NVIDIA H100 and H200 Tensor Core GPUs that are used in many AI and high-performance computing systems." - CyberScoop

CNBC notes that this scheme was worth approximately $160 million. By opening a legal, albeit taxed, channel for these chips, the White House aims to undercut the profitability of these smuggling networks while maintaining visibility into where the technology is deployed.

Strategic Context: The Rise of Domestic Competitors

The decision to relax restrictions is not merely economic; it is a response to the unintended consequences of previous bans. Tom's Hardware reports that the "White House U-turn" is partially driven by the rapid advancement of Huawei's Ascend chips. By denying China access to Nvidia hardware, the U.S. inadvertently accelerated China's domestic semiconductor innovation.

Analysts suggest that flooding the Chinese market with the H200-which, while powerful, is from 2022 and lags behind Nvidia's absolute newest bleeding-edge architecture-could stifle the growth of local competitors like Huawei by offering a superior, established product that Chinese developers prefer.

Implications for Nvidia and the Market

For Nvidia, this policy reopens access to one of the world's largest semiconductor markets. Despite the 25% fee, the demand for H200 chips in China remains insatiable for training large language models. This move is expected to bolster Nvidia's revenue, although the strict compliance requirements will add layers of bureaucratic complexity to their supply chain.

Outlook: A Fragile Balance

As we move through December 2025, the implementation of this policy faces significant hurdles. The "approved customer" vetting process will likely be a point of contention between Washington and Beijing. Furthermore, as noted by the Center for Strategic and International Studies (CSIS), broader export controls on High Bandwidth Memory (HBM) remain in place, complicating the landscape.

The success of this strategy relies on the U.S. government's ability to effectively police the "approved" list and prevent the chips from being diverted to military use. If successful, the U.S. may maintain its "dominance of the American tech stack" globally. If not, the H200s could inadvertently power the very military advances the initial bans sought to prevent.